What is a “de minimis threshold”?

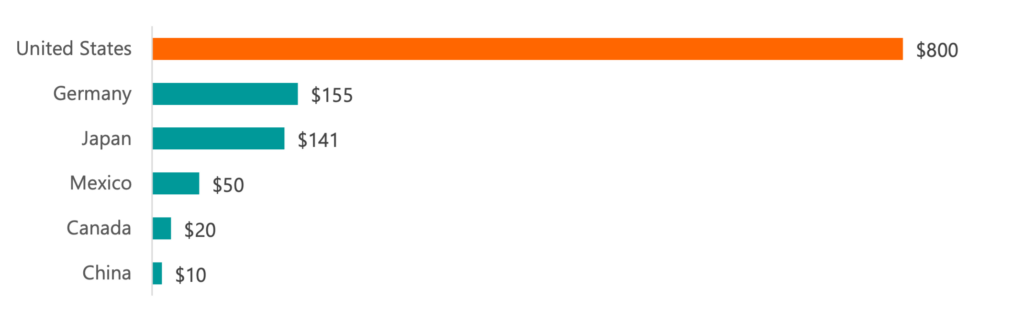

In an international trade context, a “de minimis” refers to shipments of imports falling below a minimum value and are eligible for duty-free entry, subject to certain conditions. Per Section 321, 19 USC 1321, the de minimis threshold for imports into the United States is $800 per person per day. The United States currently has the highest de minimis threshold among our primary trading partners and one of the highest thresholds in the world.

Figure 1. U.S. De Minimis Threshold Compared to Top 5 Trade Partners

Source: Global Express Organization (link); U.S. Census Bureau (link)

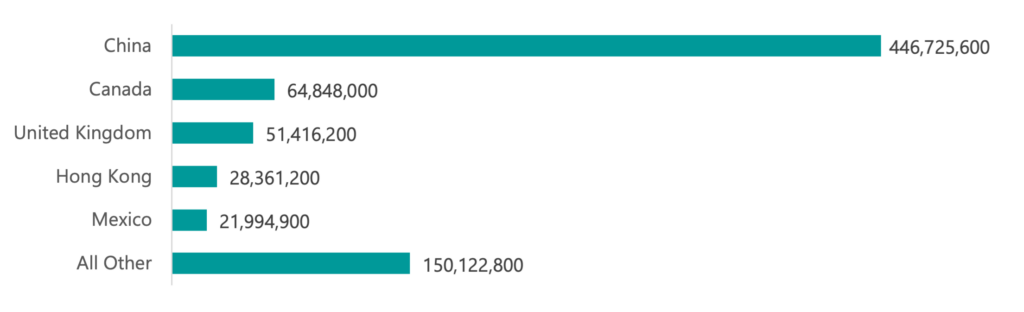

Figure 2. Top 5 De Minimis Shipment Origins (2021)

Source: U.S. Customs and Border Protection (link)

How has a higher de minimis threshold affected consumers and small businesses?

In 2015, the Trade Facilitation and Trade Enforcement Act increased the de minimis threshold from $200 to $800. According to George Mason University’s Mercatus Center, the higher de minimis threshold has lowered costs for consumers and small businesses, as more and higher-value shipments are eligible to be exempt from not only duties and taxes but also Customs brokerage fees, handling charges, and time delays typically incurred from Customs processing.[1] Since the de minimis threshold was increased, the annual volume of e-commerce shipments valued at $800 or less tripled from roughly $250M in FY 2016 to over $750M in FY 2021.[2]

Why is the de minimis threshold under scrutiny?

The primary criticisms of a higher de minimis threshold are that: (1) it creates a tax advantage for some entities, and (2) it potentially creates a vulnerability that bad actors can exploit to smuggle illicit goods into the United States. The counterargument is that the de minimis threshold is not a tax relief — rather, it is a statute that allows for low-value items to legitimately and transparently enter the United States tax-free.[3] Although de minimis shipments are exempt from taxes and duties, they are not exempt from Customs screening and are inspected at the same rates as higher-value shipments using an expedited entry process.[4]

How is Congress responding to calls to change de minimis rules?

As of September 2023, two bills in Congress seek to change de minimis.

The De Minimis Reciprocity Act of 2023 (S.1969), sponsored by Sen. Cassidy [R-LA] and cosponsored by Sen. Baldwin [D-WI] and Sen. Vance [R-OH], would:

- Forbid all Chinese imports from entering the United States via de minimis procedures

- Rather than a blanket amount, lower the de minimis threshold to match that of each trading partner for de minimis shipments originating from the U.S., and

- Require CBP to collect more information on de minimis packages.

The Import Security and Fairness Act (S.2004, H.R.4148), sponsored by Sen. Brown [D-OH] and cosponsored by Sen. Rubio [R-FL], Sen. Casey [D-PA], and Sen. Fetterman [D-PA] in the Senate, and sponsored by Rep. Blumenauer [D-OR-3] and cosponsored by Rep. Dunn [R-FL-2], Rep. Deluzio [D-PA-17], and Rep. Posey [R-FL-8] in the House of Representatives, would:

- Prohibit imports via de minimis procedures from countries that are both non-market economies and on the Office of the U.S. Trade Representative’s Priority Watch List, and

- Require CBP to collect more information on de minimis packages.

What impact would this legislation have on Washington state businesses?

If passed, these bills could impact the United States’ international trade economy and Washington state businesses, including:

Greater stress on limited CBP resources: An additional 22,000 Customs officers would be needed to subject de minimis packages to standard screening procedures.[5]

Higher costs for consumers: The absence of de minimis trade could result in cost increases due to the reintroduction of fees. For example, with no de minimis threshold, a $50 package could nearly double in cost due to the brokerage and merchandise processing fees required by typical Customs procedures.[6]

Less opportunity for small businesses to benefit from trade: Participating in the e-commerce economy via de minimis is an essential growth channel for many small businesses. Lowering de minimis would disproportionately impact small businesses, which import in smaller batches and have less administrative capacity than large businesses.[7]

How can Congress address concerns without negatively affecting small businesses?

The Washington Council on International Trade (WCIT) recommends that Congress does not pass legislation that would lower de minimis or otherwise increase costs for consumers and businesses. Concerns over compliance or illegal activities are better addressed through other measures.

- Congress should direct CBP to increase its efforts at transparency and data collection to address the misinformation about the uses of de minimis

- Clarify that de minimis shipments, while exempt from duties, are subject to the same trade policies as shipments above the threshold.